Chinese tech giant Alibaba witnessed a 3.5% decline in its shares on Monday after it made a surprising announcement that outgoing CEO Daniel Zhang would be relinquishing his roles as chairman and CEO of the company’s cloud business.

Zhang, initially scheduled to step down as CEO on Sunday to concentrate on the cloud unit, will now have his successor, Eddie Wu, also managing the cloud business. This unit represents China’s leading provider of cloud computing services and is poised for separation into six distinct entities as part of the company’s restructuring.

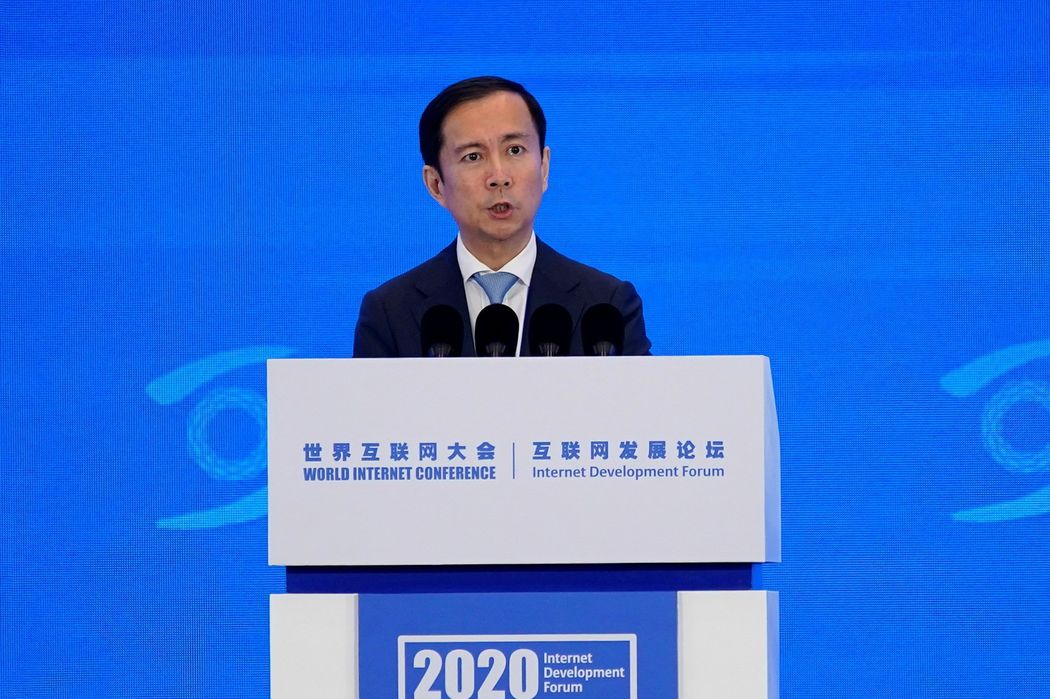

In an unexpected leadership reorganization revealed in June, Alibaba declared that Daniel Zhang would step down as both CEO and chairman on September 10, redirecting his attention towards the cloud intelligence business. Co-founder Eddie Wu would assume the role of CEO and director, while another co-founder, Joseph Tsai, was slated to become chairman starting from September, as announced by the e-commerce giant at that time.

Zhang served as Alibaba Group CEO from 2015 and became the group’s chairman in 2019. Additionally, he held the positions of chairman and CEO at the Alibaba Cloud Intelligence Group starting in 2022.

Alibaba confirmed its commitment to proceed with the separation of the Alibaba Cloud Intelligence Group and announced its intention to invest $1 billion in a technology group overseen by Zhang.

In May, Alibaba unveiled its intentions to separate its cloud division, intending to establish it as an independent, publicly traded entity. As part of a significant restructuring initiative announced in March, Alibaba had previously divided into six business groups, facilitating each unit’s ability to secure external funding and pursue initial public offerings.

Alibaba has encountered decelerating domestic economic growth and increased regulatory scrutiny from Beijing, leading to substantial losses in its share value.

(Source: Brian Swint | Barron’s | Lim Hui Jie | CNBC | Reuters | South China Morning Post)