The export of minerals in China has recently undergone significant changes, particularly in the context of essential materials required for various industries.

In a move driven by national security concerns and geopolitical tensions, China has imposed restrictions on the overseas sale of certain rare minerals, affecting global supply chains and sparking debates about the potential economic repercussions of such policies.

This shift has not only highlighted China’s pivotal role as a major producer but also raised questions about the resilience and adaptability of global industries that depend on these mineral resources.

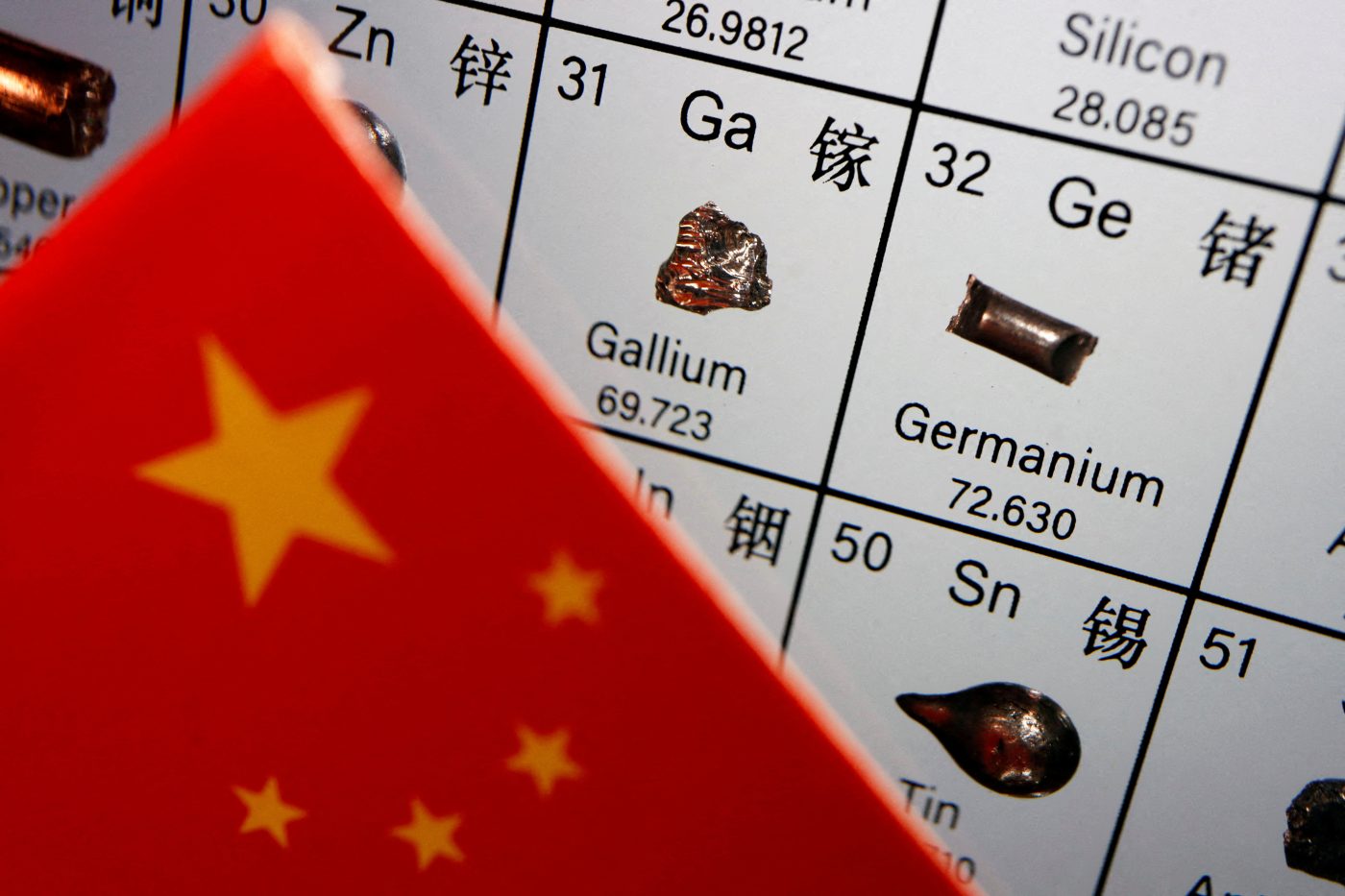

In August, China ceased exporting two crucial minerals vital for semiconductor production, following the imposition of overseas sales restrictions a month earlier, citing national security concerns. These minerals are gallium, of which China produces approximately 80% of the global supply, and germanium, responsible for about 60%. Chinese customs data reported no international sales of these elements in August, in contrast to July when 5.15 metric tons of gallium products and 8.1 metric tons of germanium products were exported.

These export restrictions appear to be a response to US export controls, despite concerns about China’s economic growth, as tensions in the technology sector persist. China is currently contending with weak domestic demand and a housing crisis, with its exports suffering a significant decline recently.

Analysts warn that limiting exports can have adverse effects on the Chinese economy and may expedite the relocation of supply chains away from the country. Although China dominates the production of these minerals, alternative producers and substitute materials are available, as noted in a July report by Eurasia Group analysts.

The repercussions of the decline in exports are already evident domestically. In China, the implementation of export controls has led to a surplus of gallium, resulting in a notable drop in prices. As of Thursday, the spot price of gallium stood at 1,900 yuan ($260) per metric ton, marking a nearly 20% decrease from its early July levels, as reported by the Shanghai Metal Market. Conversely, the spot price of germanium has seen a modest increase due to constrained supply, reaching 10,050 yuan ($1,376) per metric ton on Thursday.

Back in July, Beijing announced that export controls would be imposed on the two elements, which find applications in various products, including computer chips and solar panels. The motivation behind this move was to safeguard the nation’s “national security and interests.”

Beginning on August 1, exporters were required to seek specific authorization to export these minerals from China. This action has escalated a technology-related conflict between China and the United States, revolving around access to advanced chip manufacturing technology, which plays a crucial role in a wide range of applications, including smartphones, self-driving vehicles, and even weapons production.

In October of the previous year, the Biden administration introduced export controls, prohibiting Chinese companies from purchasing advanced chips and chip-making equipment without a license. However, the success of this campaign depended on the cooperation of other countries. Japan and the Netherlands joined this effort earlier this year, further restricting chip exports to China.

In response, Beijing initiated a cybersecurity investigation into the US chipmaker Micron in April and subsequently banned it from selling to Chinese companies involved in critical infrastructure projects. Recent developments in the tech industry, particularly Huawei’s introduction of the Mate 60 Pro smartphone powered by an advanced chip, have put political pressure on the United States to intensify sanctions against Huawei and Semiconductor Manufacturing International Corp. (SMIC), the Chinese chip manufacturer believed to have produced the semiconductor. Analysts from Jefferies noted that there is an expectation for the Biden administration to tighten the restrictions on chip exports to China in the fourth quarter.

(Source: Laura He | China | KRDO)