Doosan Robotics, South Korea’s biggest collaborative robot producer, experienced an impressive stock market debut, with its shares nearly doubling in value. The company closed at 51,400 won per share on Korea’s main stock exchange, marking a 97.69% increase from its initial public offering price. This significant growth resulted in a market capitalization of 3.33 trillion won, propelling the company into the top 100 stocks on the exchange.

The stock opened at 59,100 won, a remarkable 127.3% higher than the IPO price. Throughout the day, the share price peaked at 67,600 won before declining to a low of 46,450 won. However, it later rebounded to settle in the early 50,000-won range.

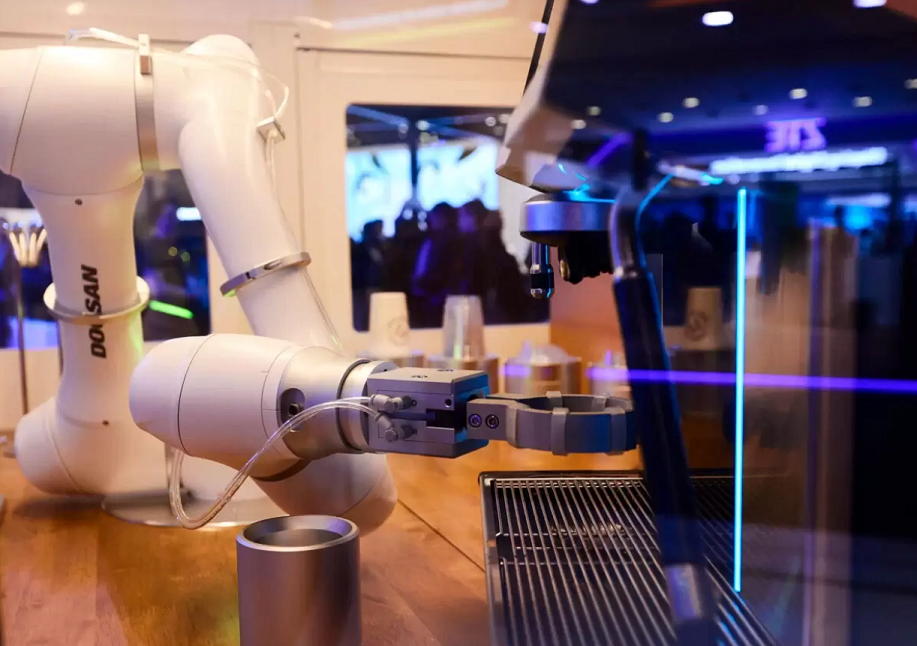

While Doosan Robotics didn’t reach the upper price limit, its doubling in value at debut propelled its market cap to surpass competitors like Rainbow Robotics. The company aims to become an integrated solution business for collaborative robots, focusing on software platforms, artificial intelligence, and autonomous mobile robots.

Doosan Robotics’ IPO was highly anticipated in the local stock market, and it attracted significant interest from both institutional and retail investors. Major players like Norway’s Norges Bank Investment Management, Singapore’s GIC, BlackRock, and Goldman Sachs participated in the IPO, along with 1,920 institutional investors in total. The subscription process received over 33.1 trillion won in deposits, the highest amount since January 2022.

Established in 2015, Doosan Robotics boasts the largest range of collaborative robot models in Korea and plays a prominent role in the robotics industry. Despite a slow IPO scene, other companies like EcoPro Materials and Seoul Guarantee Insurance are expected to make their market debuts this year.

(Source: Im Eun-byel | The Korea Herald)