TikTok has introduced a fresh shopping platform, sparking numerous comparisons to divisive fast-fashion e-commerce giants like Shein and Temu. This platform enables users to purchase and sell items directly within the app.

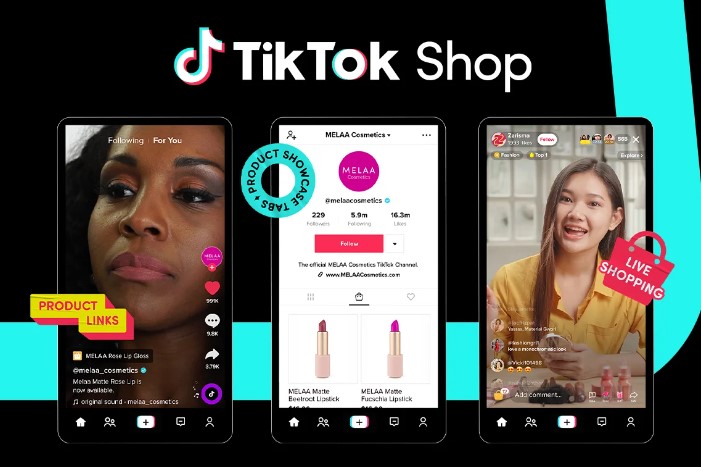

On September 12, 2023, the short-form video platform announced the introduction of an in-app shopping feature in the United States. This move comes after several months of rigorous testing. With TikTok Shop, users now have the ability to effortlessly discover and buy products featured in live videos, those tagged within content appearing on their algorithm-curated For You page, items pinned on brand profiles, or those promoted in the new “Shop” tab.

For content creators, this feature presents an opportunity to diversify their revenue streams by facilitating partnerships with brands based on commission-based marketing. Additionally, TikTok is introducing the “Fulfilled by TikTok” program, which takes care of all the operational aspects for sellers, encompassing storage, packaging, and shipping services.

For Amazon and Walmart, these two retail giants have never faced such a formidable challenge, and this could ultimately benefit consumers. On the other hand, Target provides customers with a comprehensive retail experience, whereas Walmart and Amazon primarily serve as shopping destinations. While both brands have cultivated devoted customer followings, this loyalty is largely a result of their competitive pricing and technological innovations.

The brand experience is streamlined and lacks emotional engagement or entertainment value. In contrast, TikTok boasts a dedicated user base that spends extensive periods scrolling through captivating content.

The company stated, “Through community-driven trends such as #TikTokMadeMeBuyIt, which motivate individuals to explore and endorse their beloved products, TikTok is forging a fresh shopping culture. With TikTok Shop, we’re providing users with a platform to relish the excitement of finding and buying new items, all without exiting the app.”

TikTok has ambitious plans to increase its merchandise sales fourfold by year-end, aiming for a $20 billion target, as reported by Bloomberg.

Presently, the social media platform is aiming to transform itself into an online marketplace by seamlessly incorporating e-commerce into its content feed. While this concept isn’t entirely novel—Meta’s Facebook and Instagram have experimented with it to varying extents—TikTok has amassed a distinct and potentially receptive customer base that could be open to an entirely new shopping experience.

E-commerce has often been regarded as a coveted goal for social media platforms. While Facebook has established a thriving advertising business, it’s been a challenge for most major social media platforms to directly facilitate customer purchases.

This challenge arises because individuals primarily use these platforms for entertainment or social interaction, rather than with the intention of making purchases. TikTok aims to leverage its platform’s robust user engagement to convert this engagement into tangible sales.

Amazon has experimented with shopping shows reminiscent of QVC, and Instagram has made multiple attempts to enable influencers to market products. The crucial question now revolves around TikTok, which has a predominantly younger user base that might not always have easy access to credit cards.

TikTok Shop has already launched in select areas of Asia and the United Kingdom. One of TikTok’s largest user bases, Southeast Asia, boasts a population of 630 million, with half of them being under 30 years old. According to Reuters, this region attracts over 325 million monthly visitors to the app.

Despite its impressive user numbers, TikTok has encountered challenges in converting its extensive user base into a significant source of e-commerce revenue in Southeast Asia. This difficulty stems from the intense competition it faces from established giants like Sea’s Shopee, Alibaba’s Lazada, and GoTo’s Tokopedia.

E-commerce transactions in the region totaled nearly $100 billion last year, with Indonesia alone contributing $52 billion, according to data from consultancy Momentum Works. While TikTok facilitated $4.4 billion in transactions across Southeast Asia in 2022 (a significant increase from $600 million in 2021), it still lagged far behind Shopee’s $48 billion in regional merchandise sales for the same year, as reported by Momentum Works in June.

TikTok’s attempts to establish a foothold in the United States have faced considerable challenges. The TikTok Shop, launched on Tuesday, had been in testing since November. Prior efforts to venture into e-commerce, including a partnership with Shopify in 2021 and live shopping initiatives, encountered difficulties and were not successful.

This renewed focus on e-retail in the United States comes at a time when TikTok is under increasing scrutiny from lawmakers. Some critics and a growing number of bipartisan US lawmakers view TikTok, owned by China-based company ByteDance, as a potential national security threat. Concerns have been raised about the Chinese government potentially accessing US user data through TikTok, although no evidence has been found to support such claims thus far.

(Source: Daniel Kline | The Street | Jennifer Korn | CNN |