Amazon, the global e-commerce behemoth, has redefined the way people shop and consume goods in the digital age.

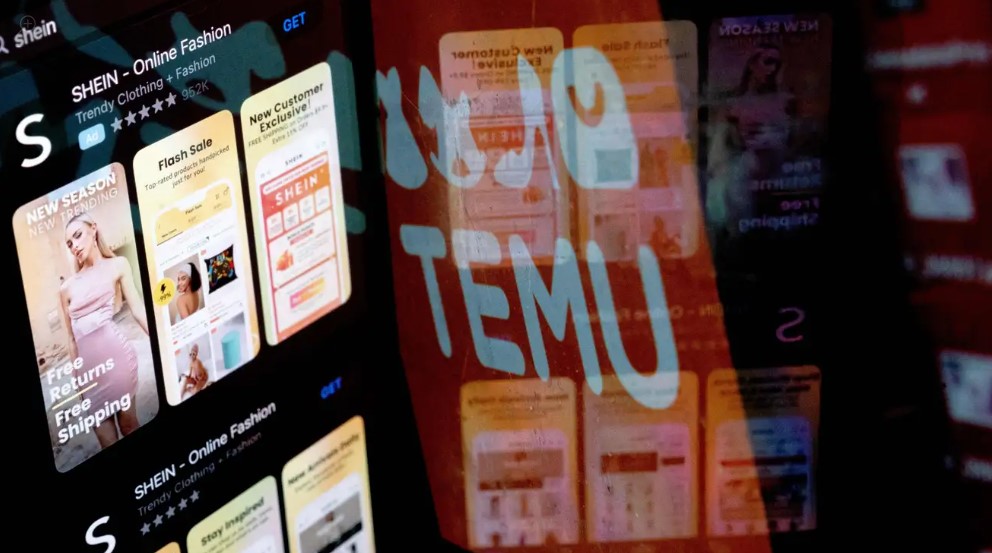

Although Amazon has long grappled with competition from giants like Walmart and Target, the e-commerce giant was taken aback by the surging popularity of shopping platforms Shein and Temu, both with Chinese origins, among American consumers. Both platforms are capitalizing on the market’s appetite for affordable products with less emphasis on speedy delivery.

According to insiders, Amazon has refrained from matching Temu’s prices, an unusual move for a company known for employing various price-matching tools to maintain competitive pricing on its platform. Within the tech giant’s ranks, executives have been deliberating on how to address these two rivals. They’ve recognized the demand for budget-friendly items with longer delivery times and are exploring ways to make such products more visible and accessible on their own platform.

Temu and Shein have seen a rising willingness among inflation-conscious American consumers to give them a try. According to estimates by analytics firm Comscore, since their U.S. services were introduced in September 2022, the number of monthly unique visits to Temu’s website and app, which measures how frequently shoppers engage with the platform, surged by over tenfold, reaching approximately 70.5 million by March.

Comscore’s estimates indicate that Amazon’s monthly unique visitors dipped to around 211 million in March, down from approximately 217.5 million in September 2022. Similarweb and Sensor Tower, two data firms, observed comparable web and app traffic patterns for Temu, Shein, and Amazon in recent months.

From August 2021 to March, Shein witnessed a near doubling of its monthly unique visitors in the U.S., reaching approximately 41 million.

The popularity of Temu and Shein has emerged as a significant challenge to Amazon’s dominance in the U.S. e-commerce market, following previous disruptions. While Amazon’s market share in U.S. online shopping had steadily increased for several years, it has plateaued at approximately 38% since 2021, with projections from research firm Insider Intelligence indicating that it will likely remain at this level for at least the next year. In contrast, newer entrants like Temu and Shein have been steadily attracting U.S. customers, while other established players such as Amazon, Target, eBay, and furniture retailer Wayfair are experiencing stagnant or declining market shares.

Shein, America’s largest fast-fashion seller, has expanded its reach by opening a marketplace for U.S. customers. This marketplace allows independent merchants, including numerous Amazon sellers, to offer their products on Shein’s platform. Notably, Shein recently partnered with Forever 21, enabling the Singapore-based online fashion retailer to sell its products on Shein’s site and app.

Customers are drawn to Shein and Temu for their affordability. These companies keep costs low by avoiding the need for large U.S. warehouses and instead ship products directly from China based on consumer demand, even if it means longer delivery times, typically around a week or more.

Shein, recognized for its rapid adaptation to fashion trends, continually updates its inventory and has become a go-to destination for fast fashion. While remaining a leader in fashion, Shein is also exploring opportunities to diversify its product offerings. In contrast, Temu offers a wide range of products, contributing to the appeal of these platforms for budget-conscious shoppers.

On various online review platforms and discussion forums, a portion of Shein and Temu customers have voiced their apprehensions regarding the quality of products they receive. These customers have indicated that they tend to limit their purchases to items less susceptible to damage during shipping, such as hair clips or laundry bags, to mitigate the risk of receiving subpar products.

Shein and Temu usually find it challenging to rival Amazon when it comes to leveraging the delivery benefits associated with Amazon’s Prime subscription service, primarily due to Amazon’s extensive and well-established logistics network, which the company has painstakingly developed over several years.

Shein and Temu are under regulatory scrutiny in the U.S. due to concerns related to their cotton sourcing practices. Lawmakers and Republican attorneys general from numerous states have raised questions about whether these companies obtain cotton from China’s Xinjiang region, which has been accused by the U.S. government of engaging in genocide and employing forced labor, particularly against the Uyghur Muslim population.

Shein has asserted that it does not source cotton from China and has no affiliations with suppliers in Xinjiang. In contrast, Temu has not provided any comments or responses to these inquiries. Beijing has consistently denied the allegations made against it.

As U.S. consumers remain vigilant in the face of inflation, it is crucial to stay informed, budget wisely, and explore other retail platforms to mitigate its impact.

(Source: Sebastian Herrera |Shen Lu | WSJ)