In a world where semiconductors are the lifeblood of technology, the delicate balance of geopolitical tensions and technological prowess has taken center stage. Recent revelations indicate that ASML Holding and Taiwan Semiconductor Manufacturing Company (TSMC), two titans of the chip-making industry, have developed sophisticated measures to disable their cutting-edge machinery in the event of a Chinese invasion of Taiwan. This revelation, shared by insiders privy to the situation, underscores the intricate interplay between global politics and advanced technology.

Amidst rising tensions and concerns over potential Chinese aggression, U.S. government officials have privately voiced their apprehensions to their Dutch and Taiwanese counterparts. The U.S. is particularly wary of what might transpire if China were to escalate its posturing into a full-scale attack on Taiwan, a crucial node in the global semiconductor supply chain.

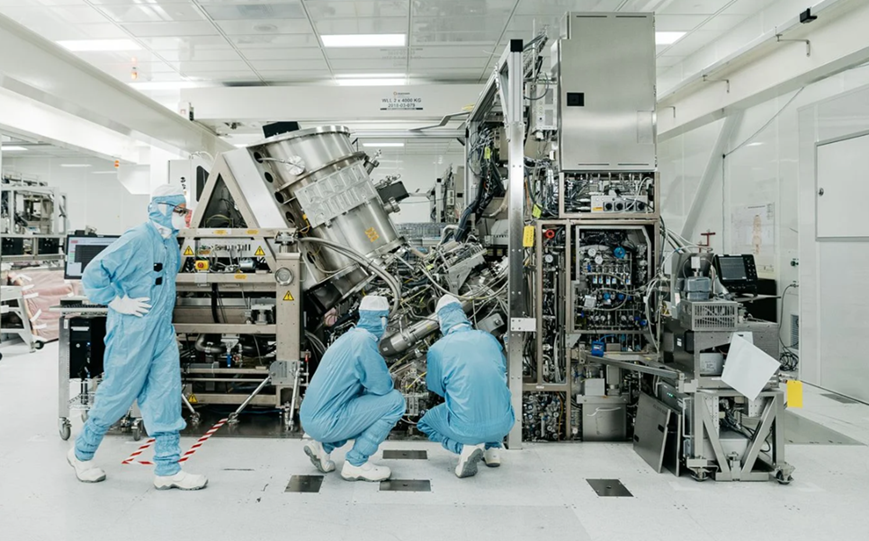

ASML, a Dutch company that stands as the world’s sole manufacturer of extreme ultraviolet (EUV) lithography machines, has reportedly assured the Dutch government of its capability to remotely disable these vital machines. This reassurance came during high-level discussions focused on assessing the risks posed by a potential invasion. The Dutch government, in response, has conducted simulations to gauge the implications of such a scenario.

These EUV machines, which cost over €200 million (approximately $217 million) each, are essential for producing the smallest and most advanced microchip transistors. TSMC, ASML’s largest client, heavily relies on these machines for its chip production, which is integral to both artificial intelligence applications and sensitive military technologies. Regular maintenance and updates are crucial for these machines, and ASML retains the capability to remotely shut them down, effectively acting as a kill switch.

This technological safeguard is part of broader efforts by Western governments to prevent critical technologies from falling into the wrong hands. The Netherlands, at the behest of the U.S., has already restricted ASML from selling its EUV machines to China. This year, the Dutch government further tightened these restrictions, halting exports of ASML’s next-most advanced machines. These measures have affected up to 15% of ASML’s sales to China, highlighting the economic stakes involved.

Despite these restrictions, China’s technological advancements continue unabated. Huawei Technologies, for instance, has managed to produce a smartphone that rivals Apple’s iPhone, using older ASML equipment and tools from U.S. suppliers. This achievement underscores Beijing’s commitment to technological self-sufficiency, a national priority bolstered by significant government support.

The geopolitical backdrop to these technological maneuvers is China’s long-standing claim over Taiwan. President Xi Jinping has consistently advocated for reunification with Taiwan and has not ruled out military intervention. With China rapidly expanding its military capabilities, a top U.S. admiral testified earlier this year that the superpower is preparing to be capable of invading Taiwan by 2027. In response, the U.S. Congress has approved $8 billion in aid to bolster Taiwan’s defenses, and the Biden administration is pushing to enhance domestic semiconductor production with $39 billion in grants.

As Taiwan’s new president, Lai Ching-te, takes office, the stakes have never been higher. With Taiwan producing around 90% of the world’s most advanced chips, any disruption to its semiconductor industry would have far-reaching consequences. TSMC’s chairman, Mark Liu, has hinted that any attempt to seize control of their facilities by force would render them inoperable, a sentiment that echoes ASML’s remote shut-off capabilities.

ASML’s rise to become Europe’s most valuable tech stock, with a market capitalization exceeding $370 billion, is a testament to the critical role its technology plays in the global supply chain. Since the development of EUV machines in 2016, ASML has shipped over 200 units to clients worldwide, excluding China, with TSMC being its biggest customer. The reliance on ASML’s maintenance services further emphasizes the interdependence within the semiconductor industry.

In a world where the lines between technology and geopolitics are increasingly blurred, the ability to safeguard critical infrastructure against potential threats is paramount. The measures taken by ASML and TSMC exemplify the proactive steps necessary to navigate the complex landscape of global technological dominance and political instability.

(Source: Bloomberg | Seeking Alpha | SCMP)