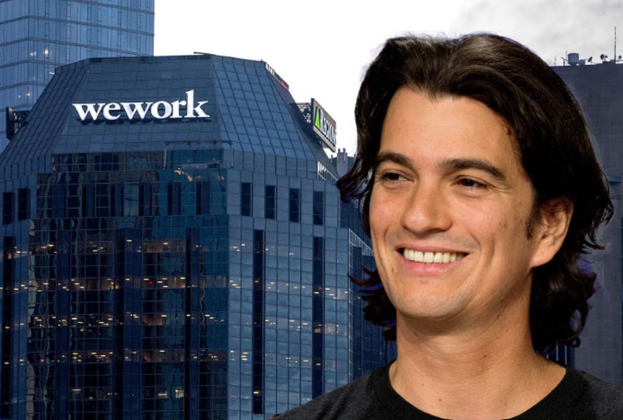

In a surprising turn of events, Adam Neumann, the ousted co-founder of WeWork, has submitted a bold bid exceeding $500 million to acquire the company out of bankruptcy. Sources suggest that this bid could potentially rise to a staggering $900 million pending further due diligence, adding a new twist to WeWork’s tumultuous journey.

The details of Neumann’s financing remain shrouded in mystery. Despite earlier claims that Dan Loeb’s Third Point was backing Neumann’s offer, sources close to the matter have confirmed that Third Point is not involved. This revelation, along with concerns about Neumann’s past decisions at the helm of WeWork, could raise doubts about the viability of his bid.

Neumann, along with his family office Nazare and his real estate venture Flow, has officially entered the fray by filing a notice of appearance in WeWork’s bankruptcy docket. This move comes on the heels of reports indicating Neumann’s renewed interest in regaining control of the company he helped build.

The complexity of Neumann’s bid could complicate WeWork’s ongoing bankruptcy proceedings. The company has been working to restructure its business and shed underperforming assets, including rejecting numerous leases. However, some lessors have resisted these efforts, leading to legal battles that could further delay WeWork’s recovery.

In response to Neumann’s bid, a spokesperson for WeWork stated, “WeWork is an extraordinary company and it’s no surprise we receive expressions of interest from third parties on a regular basis. Our Board and our advisors review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company.”

It remains to be seen how WeWork’s board and stakeholders will respond to Neumann’s offer. As the bankruptcy proceedings unfold, the fate of WeWork hangs in the balance, with Neumann’s bid adding a new layer of intrigue to the company’s uncertain future.

(Source: WSJ | Business Insider | CNBC)