In a stunning display of strength, Nvidia’s shares surged over 14% in premarket trade following the release of its fiscal fourth-quarter earnings report, which exceeded Wall Street’s expectations by a wide margin.

The tech giant reported a staggering $22.10 billion in revenue for the quarter, marking a remarkable 265% increase from the previous year. Net income also skyrocketed, soaring by an impressive 769%, fueled by the continued enthusiasm surrounding artificial intelligence (AI).

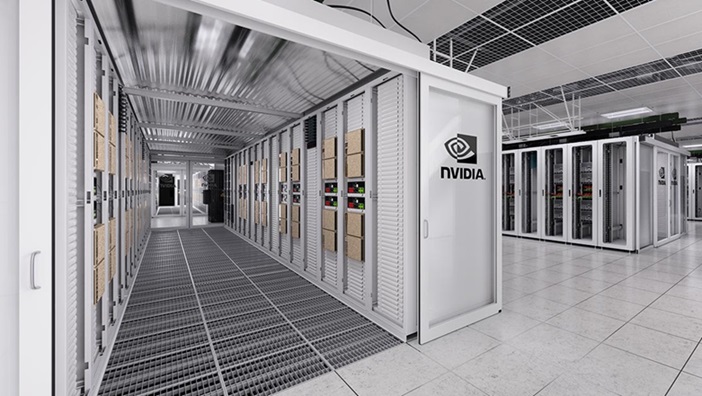

Nvidia’s chips play a crucial role in training massive AI models, including those developed by industry heavyweights like Microsoft and Meta. The company shows no signs of slowing down, with a bullish outlook that forecasts revenue in the current quarter to reach $24 billion, significantly outpacing analysts’ estimates.

During the earnings call, Nvidia’s CEO Jensen Huang expressed confidence in the company’s growth prospects, stating, “Fundamentally, the conditions are excellent for continued growth in 2025 and beyond.” This optimistic outlook has further bolstered investor confidence in the stock.

Nvidia’s Data Center business, which includes its high-performance H100 graphics cards used for AI training, reported sales of $18.4 billion for the quarter, representing an astounding 409% year-on-year growth. The company’s stellar performance prompted a flurry of upgrades from analysts, with JPMorgan raising its price target on Nvidia’s stock from $650 to $850, and Bank of America Global Research hiking its target from $800 to $925.

Despite concerns leading up to the earnings report, including profit-taking by traders and worries about meeting high expectations, Nvidia’s exceptional results have not only dispelled these fears but have also lifted other global chip stocks in its wake.

Nvidia closed at $674.72 on Thursday, capping off a remarkable day for the company and its shareholders. With its continued innovation and strong performance in the AI space, Nvidia’s meteoric rise shows no signs of slowing down.

(Source: Investor’s Business Daily | CNBC | NYT | Bloomberg)